Following up on my earlier post about BigCommerce's rebrand announcement, I got my hands on the Cleveland Research analysis from their Q2 earnings call. The numbers reveal this transformation goes much deeper than a name change.

Cleveland Research confirms what I suspected: this rebrand reflects a unified product suite positioning for the agentic commerce era. Commerce now represents:

One of the key insight's from the research was the name "Commerce" can work across the ecosystem. Sometimes as the platform, other times as just the data and orchestration layer. That flexibility is everything in an AI-driven world.

Q2 2025 results show a company that's found its footing:

Travis Hess and team expects real growth acceleration in H1 2026.

They're building infrastructure now, monetizing later.

The research identifies specific opportunities:

1. Data as the New Storefront As AI agents become the front door to product discovery, merchants with clean, enriched data will dominate buyer journeys. Feedonomics becomes mission-critical infrastructure.

2. AI Agents = New Channel AI agents shopping for humans represents entirely new order volume and GMV growth.

3. Paid AI Features Commerce plans monetizable AI features around agentic search and AI-optimized product data.

Buried in the research: "Disproportionate amount of net new bookings have been B2B."

Manufacturers and distributors are showing urgency to digitize and leverage AI. The new PROS partnership for CPQ functionality isn't just about features, it's about capturing B2B use cases where the real money lives.

New integrations tell the story:

These aren't just partnerships - they're positioning moves for AI-driven commerce.

Three major product launches coming:

The messaging: "We're building the foundation now, scaling revenue later."

While competitors focus on traditional platform features, Commerce is betting everything on AI-driven commerce infrastructure. The rebrand signals their evolution from e-commerce platform to AI-enabled commerce ecosystem.

Traditional commerce happened on websites. AI commerce happens across multiple surfaces - answer engines, chatbots, voice assistants. Commerce is positioning to orchestrate all of it.

The question isn't whether AI will reshape commerce - it's whether Commerce can execute fast enough to own the infrastructure layer.

Are we witnessing the birth of AI-native commerce infrastructure, or just clever positioning? The next 18 months will tell us everything.

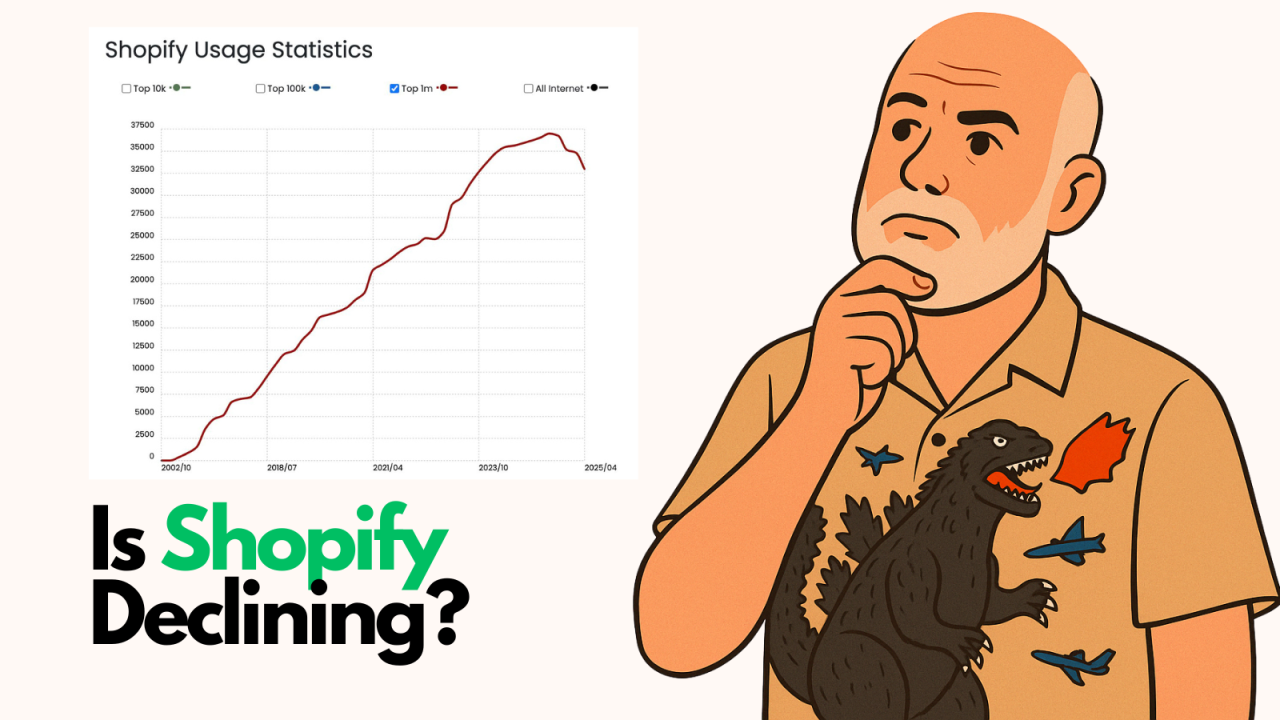

By Brent W Peterson AI vs Shopify: Is Platform Dominance Ending in 2025?

The B2B OG Reality Check In 1995, I built my first B2B website for my then computer assembly company. It...

"No CTO ever got fired for choosingShopify"